Yasmin Qureshi Labour Member of Parliament for Bolton South East

I was recently contacted regarding payday lenders and the case of Danny Cheetham.

Danny’s initial loan was only £100, but it spiralled into £19,000, with payday lenders continuing to offer loans to Danny despite knowing about his gambling addiction. Thankfully, Danny recently said that he has beaten his addiction and is in the process of paying-off his debts, which he hopes to clear within a year.

However, there are many more people in the UK like Danny, who are still being lent money by payday lenders despite their known gambling addictions. These people should be protected by the Financial Conduct Authority (FCA), but, the FCA is currently failing on this issue.

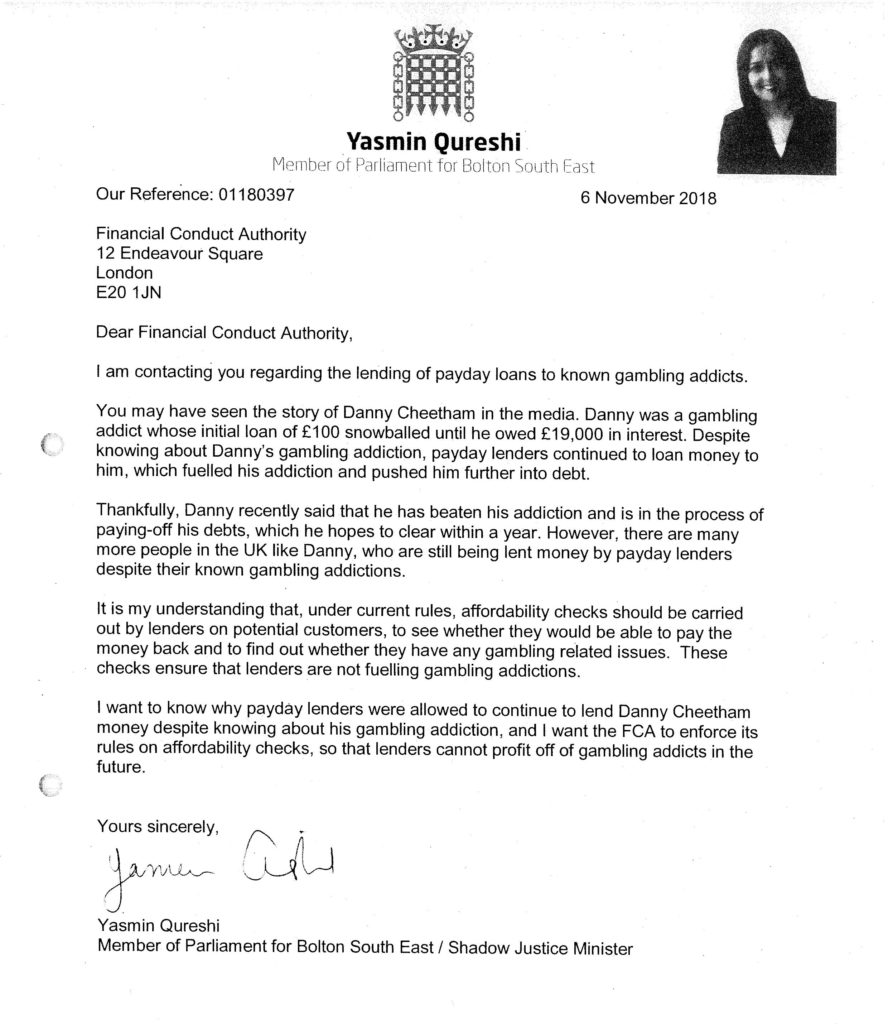

Therefore, I have written directly to the FCA, asking them to comment on the case of Danny Cheetham and to enforce their rules on affordability checks. I have posted a picture of the letter below.

As a broader point, I believe that the UK has a broken model of consumer credit. The business model of payday lenders such as Wonga, which collapsed in August this year, is exploitative and immoral. I believe they demonstrate much of what is wrong with our economy: too many people stuck in insecure employment and reliant on short-term debt to keep their heads above water.