Yasmin Qureshi Labour Member of Parliament for Bolton South East

The pub sector supports 900,000 jobs, generates £23 billion in economic value and provides £13 billion in tax revenues. In addition, 30 million adults visit the pub every month, with pubs being a key part of Britain’s social fabric.

However, pubs continue to be under severe threat and I believe that we must do what we can to support them.

At the 2018 Budget, the Chancellor confirmed that duty rates on beer, cider and spirits will remain frozen. I know that this announcement has been welcomed by many stakeholders in the pub sector, including the Campaign for Real Ale and Long Live the Local.

The Government also announced that there would be one-third off business rates for all retail premises up to a rateable value of £51,000 in 2019-20 and 2020-21. The Chancellor has said that this will give an annual saving of up to £8,000 for up to 90% of all independent shops, pubs, restaurants and cafes.

However, these suggested changes only make good on the damage done by the Government’s botched evaluation back in 2017. I am also concerned that this relief represents only a temporary respite rather than long-term support.

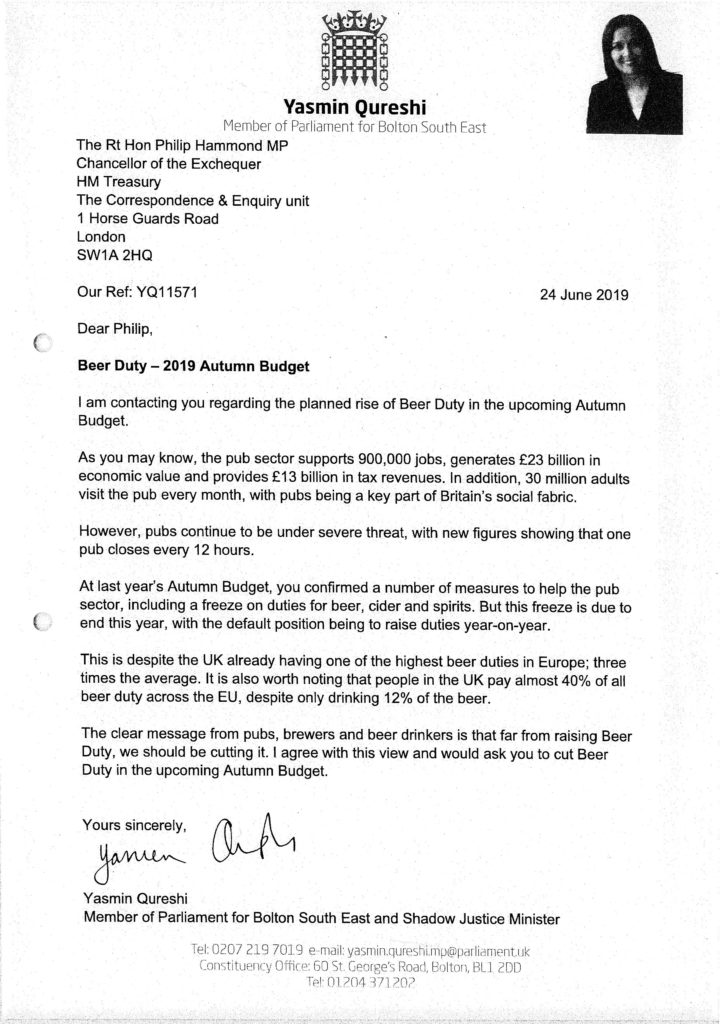

This is why I have written to the Chancellor, Philip Hammond, and asked him to cut Beer Duty in his Autumn Budget. You can see a copy of the letter below.

On beer and pubs more generally, at the 2017 general election I stood on a manifesto that committed to set up a national review of local pubs to examine the causes for their decline, as well as establishing a joint taskforce that will consider their future sustainability. I also pledged to give communities more power to shape their town centres, including by strengthening powers to protect pubs.

I believe we need a proper root-and-branch review of the business rates system, including making revaluations annual to stop small businesses from facing sharp and unmanageable increases. In addition, I think that it would be sensible for the Government to look at the whole framework for alcohol duties.

Over the last few years I have repeatedly raised the concerns of the pub and brewing sector with the Government, and I can assure you that I will continue to do so.